Letter Of Explanation Of Derogatory Credit - 48 Letters Of Explanation Templates Mortgage Derogatory Credit - ← getting a loan to build a house best 30 yr fixed rates →

Letter Of Explanation Of Derogatory Credit - 48 Letters Of Explanation Templates Mortgage Derogatory Credit - ← getting a loan to build a house best 30 yr fixed rates →. It's designed to give the lender a better sense of your current financial. Differences in addresses the federal trade commission (ftc) enforces an address discrepancy rule which puts the burden on mortgage loan originators, brokers, lenders and banks to report your correct address to the various credit agencies. Here's whatever you have to recognize to compose a letter that truly offers your skills. Each explanation is in response to the corresponding derogatory item(s) listed in section 3. My family is quite large, we have children, and we have been renting.

Use these sample letters of explanation for derogatory credit as templates for your formal letter. Our current accommodations are too small and my children long for a yard to play in. My family is quite large, we have children, and we have been renting. Writing a letter of explanation for derogatory credit from www.creditcards.com. Make sure that your borrower's credit explanation letter corresponds with the credit report.

This letter is written in response to the request for verification of the period bad credit by your lending institution.

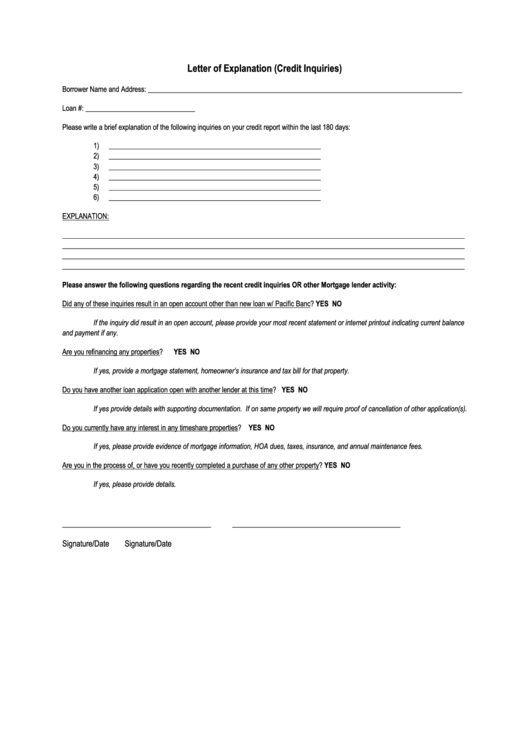

Don't allow this demand derail you. A lender may ask for a credit explanation letter to clarify a bad credit score. Derogatory marks on your credit history lower your credit score, which lenders view as risky. When consumers experience financial difficulties that cause their credit rating to go down, they may have trouble getting new credit, a new job or insurance at a reasonable rate. At its most effective, it is formal, professional and to the point, addressing specific items on a credit report as singled out by the lender. Writers should make the letter concise and only address the items the mortgage underwriter would like clarified. In section 4on page two and three, provide an explanation for each derogatory item(s) which appears on your credit report you have obtained. Differences in addresses the federal trade commission (ftc) enforces an address discrepancy rule which puts the burden on mortgage loan originators, brokers, lenders and banks to report your correct address to the various credit agencies. If there are five derogatory items, make certain that all five are addressed rather than just two or three. For instance, a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money. Example letter of explanation for derogatory credit collection. It's designed to give the lender a better sense of your current financial. Draft separate letters for each of the accounts or inconsistent information the lender is questioning.

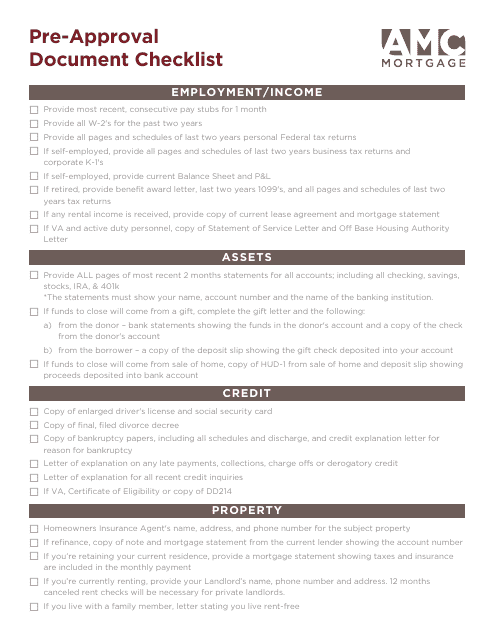

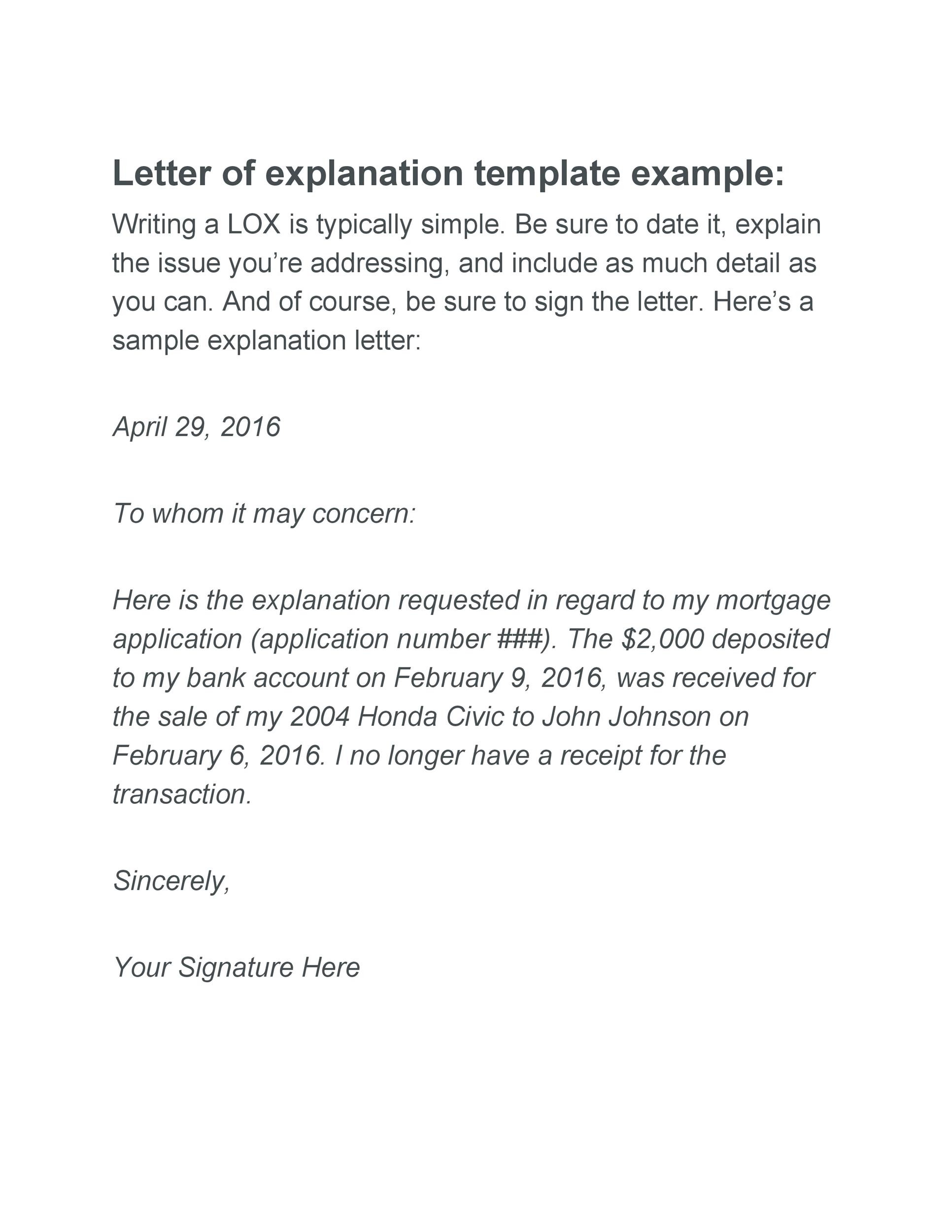

A letter of explanation, from the word explanation itself, is a document that answers and explains the questions that are in the mind of an underwriter concerning your finances. A letter of explanation is a brief document you can use to explain anything in your financial or employment documents that might make an underwriter pause. And also, scroll down to see an example cover letter you can utilize to craft your. Templatelab.com exactly how should a cover letter look? This letter is written in response to the request for verification of the period bad credit by your lending institution.

← getting a loan to build a house best 30 yr fixed rates →

This explanation works best if your credit delinquencies coincide with your dates of unemployment. For example, the explanation in section 4.1will be in response to the derogatory item(s) of section 3.1. Some lenders may ask you to write letters of explanation before submitting your file to underwriting. At its most effective, it is formal, professional and to the point, addressing specific items on a credit report as singled out most loan officers still simply give the. A credit letter of explanation needs the detail of your any credit approval. Don't allow this demand derail you. Be expert, with appropriate punctuation and also grammar, and also crucial do utilize them. Draft separate letters for each of the accounts or inconsistent information the lender is questioning. Differences in addresses the federal trade commission (ftc) enforces an address discrepancy rule which puts the burden on mortgage loan originators, brokers, lenders and banks to report your correct address to the various credit agencies. A letter of explanation, from the word explanation itself, is a document that answers and explains the questions that are in the mind of an underwriter concerning your finances. Writing a letter of explanation for derogatory credit. Make sure that your borrower's credit explanation letter corresponds with the credit report. Each explanation is in response to the corresponding derogatory item(s) listed in section 3.

These themes supply excellent examples of how you can structure such a letter, as well as include sample content to work as an overview to format. However, a letter of explanation for derogatory credit may help convince the creditor, employer or insurance company to favor the consumer's request. A credit letter of explanation is documentation provided by the borrower. A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates. For instance, a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money.

Writing a letter of explanation for derogatory credit.

Differences in addresses the federal trade commission (ftc) enforces an address discrepancy rule which puts the burden on mortgage loan originators, brokers, lenders and banks to report your correct address to the various credit agencies. At its most effective, it is formal, professional and to the point, addressing specific items on a credit report as singled out by the lender. My family is quite large, we have children, and we have been renting. 48 letters of explanation templates mortgage derogatory credit from templatelab.com derogatory items on your credit report. Writers should make the letter concise and only address the items the mortgage underwriter would like clarified. These themes supply excellent examples of how you can structure such a letter, as well as include sample content to work as an overview to format. It's designed to give the lender a better sense of your current financial. Sample letter of explanation for derogatory credit for employment for your needs. These layouts provide excellent instances of ways to structure such a letter, as well as include sample content to work as an overview of design. There a number of reasons a lender might request a letter of explanation, but here are six of the most common. Underwriters will often ask for lox when the following occurs any late payments and/or derogatory on credit report, underwriters will need an explanation for it. However, a letter of explanation for derogatory credit may help convince the creditor, employer or insurance company to favor the consumer's request. Here a common sample is provided as for your use.

Komentar

Posting Komentar